Auto insurance can be confusing, but two essential components—bodily injury liability and property damage liability—are crucial in protecting your finances in case of an at fault accident. This blog post will break down these key coverages and explain why having the right liability limits is so important.

What is Bodily Injury Liability?

Bodily injury liability (BI) covers the medical expenses and legal costs of people injured in an accident that you caused. This coverage helps protect you financially by paying for:

- Medical bills – Hospital stays, surgeries, and rehabilitation.

- Lost wages – Compensation for income lost due to injuries.

- Legal fees – Costs associated with defending yourself in a lawsuit and rewards granted.

For example (a perfect example for drivers that have families like mine), if you’re driving and get distracted by your kids in the back seat, causing a collision with another vehicle, your BI coverage would help pay for the injuries sustained by the driver and passengers in the vehicle that you caused an accident with. In addition, if that driver and/or passengers decided to file a lawsuit against you, your BI limits would also help cover the lawsuit. While I highly recommend higher limits, to save time let us look at Georgia’s required minimum liability limits to see how much your insurance policy could pay out to the other parties.

Georgia’s Minimum BI Requirements:

$25,000 per person bodily injury

$50,000 per accident BI (aggregate limit)

What is Property Damage Liability?

Property damage liability (PD) covers the cost of repairs or replacement of another person’s property that you have damaged in an accident. This includes:

- Other vehicles

- Buildings

- Fences and mailboxes

- And much more

Georgia’s Minimum PD Requirements:

$25,000 per accident property damage

It doesn’t take much. Even causing an accident with a newer Ford Expedition, an extremely common vehicle, can leave your wallet in pain. Without sufficient property damage liability coverage, you might have to pay thousands of dollars out-of-pocket to cover repairs or replacement.

Why You Should Increase Your Coverage

You may think these minimum required liability coverage limits are enough; however, this is very often not the case. Many people assume that higher coverage means significantly higher premiums. However, increasing your BI and PD liability limits often costs much less than you might expect. Paying a little extra each month could save you from financial disaster down the road.

Think of it this way—would you rather pay an extra $50 per month for peace of mind or risk losing valuable assets if you’re underinsured?

How to Evaluate Your Coverage Needs

To ensure you’re adequately protected, consider the following:

- Your assets: The more assets you have (home, savings, etc.), the more coverage you need to protect them.

- Your driving habits: Frequent driving increases your risk of accidents.

- Potential medical costs: Healthcare expenses continue to rise, making higher BI coverage crucial.

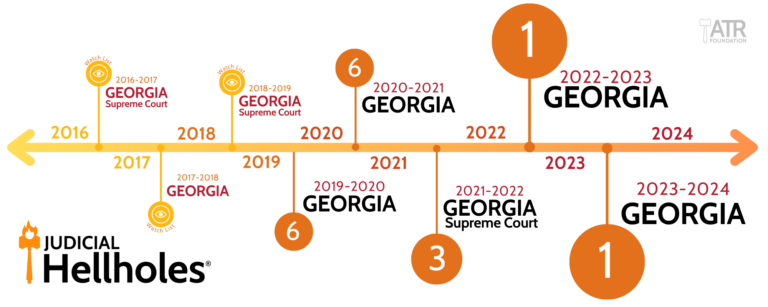

- Severity of litigation in your state: Georgia is one of the worst states when it comes to accident litigation. Always keep this in mind. See link for more explanation on this: Georgia – Judicial Hellholes

Final Thoughts

Auto insurance isn’t the most exciting topic, but having the right coverage can prevent financial hardship in the event of an accident. Don’t settle for the bare minimum—evaluate your needs and consider increasing your limits to better protect yourself and your loved ones.

If you have questions about your coverage, reach out to a trusted insurance advisor who can guide you in finding the best policy for your situation.

Drive safe and stay protected!

Authored by: Brandon A. Carlson, CWCA